If you haven’t already read part 1, do so now because this strategy builds on the first part of the strategy I discussed. So what do you do once you have successfully obtained the lease information sheet from the dealer? Easy. Go to more dealerships and have each one print out another lease information sheet (with a better deal) before moving on to the next dealership. Okay, some of you smart ones may have figured out exactly where I’m going with this, but read on as I will include some important tips and strategies.

So let’s say that after doing whatever negotiation you did with the dealer to get the lowest selling price possible and the highest residual value possible, you were given a deal where you had to put down $1,500 with a payment of $250 for a brand new Toyota Camry. The lease information sheet that you asked the dealer to print for you should list both of these exact values. What you do next is you take the lease information sheet and go to a different Toyota dealership. Once you get there, you find or ask for the sales manager and you tell him that the last dealership you went to gave you the deal listed on this lease information sheet (show him the sheet), but you cannot afford to pay $250 per month; the most you can pay is $230 per month. After you tell him this he will probably take the lease information sheet, go to his computer and punch in some new numbers in a computer program that tells him what all the different numbers come out to if he changes certain variables. For example, he may reduce the selling price a couple hundred dollars to see how much that lowers your monthly payment.

In the end he will give you a new deal with a payment that could be $5 or maybe $10 cheaper. When he offers you the new deal, you once again ask this new dealer to give you a print out of all the lease details so you can see it all visually and make sure all the calculations were done properly. After he hands you the new lease information sheet, observe it for a few minutes and then come up with an excuse to get the hell out of his dealership, because you got exactly what you needed — a new lease information sheet with a cheaper monthly payment.

What do you do next? Well, this should be pretty obvious. You take this new lease information sheet and you visit yet another dealership and give them the same pitch you gave them at the previous dealership. Your monthly payment will again be reduced another $5 or $10 dollars. When he gives you the new lease deal, you can either close the deal or you can move on to yet another dealership with your new lease information sheet.

Let me sum up the specific steps of this strategy to make sure you know the basic steps:

- You take your lease information sheet to a different dealership and you basically ask for a better deal, because you pretend that you cannot afford the payment that the last dealer has given you.

- When he offers you a new lease deal (i.e. He gives you a new, lower monthly payment), you have two choices:

b. Have the dealer print out a new lease information sheet and repeat step 1.

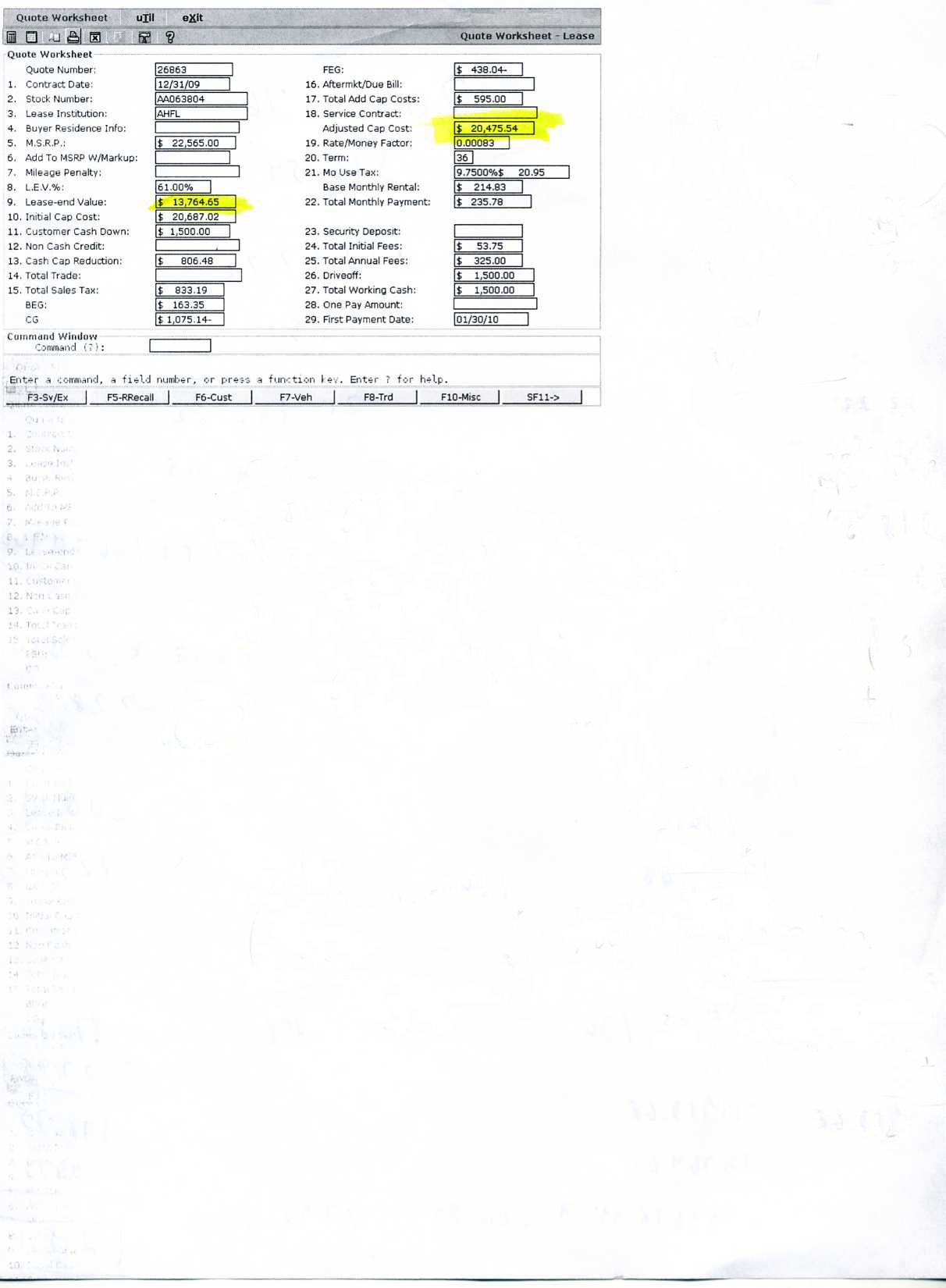

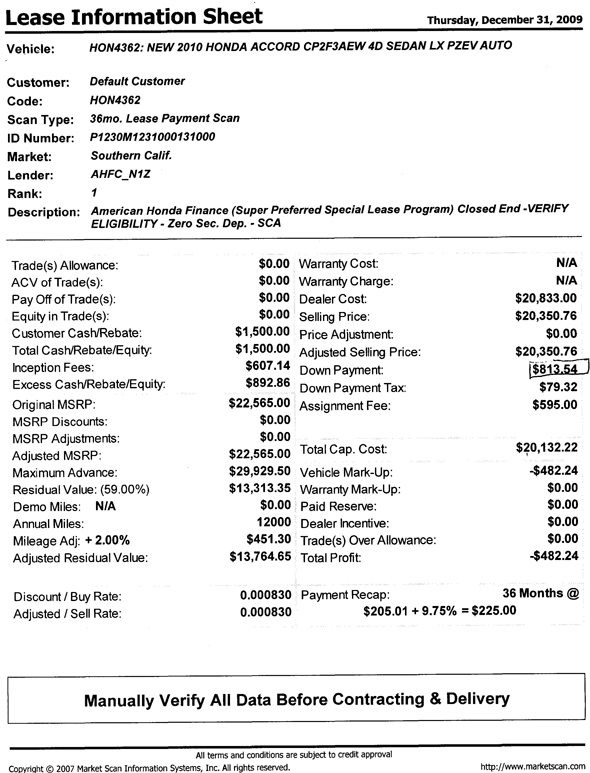

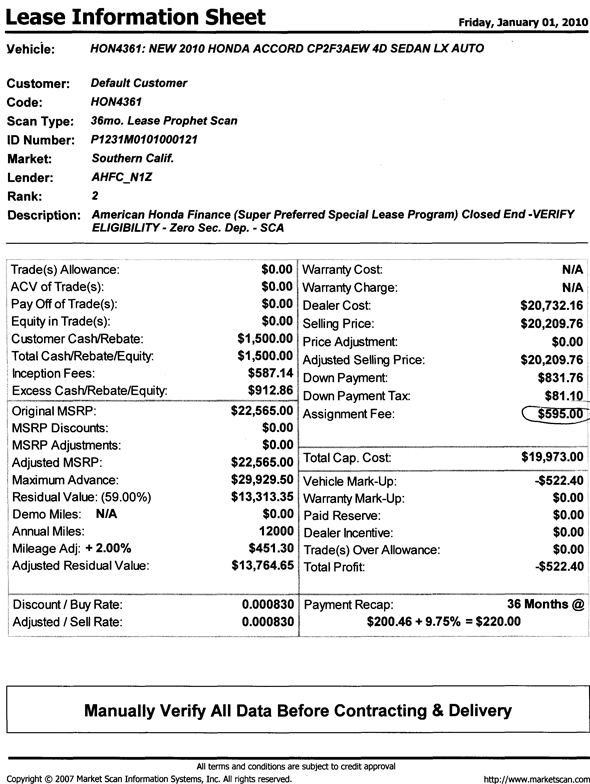

By now you may be wondering whether this technique actually works. Well, it worked for me and I do not see why it wouldn’t work for anyone else. In my case, the first Honda dealership offered me a $235.78 payment, the second offered me a $225.00 payment, and the third dealership offered me a $220.00 payment. So I saved close to $16 per month by simply going to two other dealerships. Heck, the last dealership reduced my payment by $5.00 as a way of thanking me for coming to their dealership. So saving about $16 every month over the 36 month term of my lease means that I will save a total of $576 dollars.

Here are scans of the three different lease information sheets reflecting the 3 deals I was offered. The last scan is of the deal that I accepted:

The question that remains though is whether I could have reduced my payment even further if I were to go to even more dealerships. Well, it would definitely be possible, but I was already pretty amazed that I went from paying $250 for a 2007 Honda Accord to paying $220 for a 2010 Honda Accord. Not only did I get a newer, more advanced vehicle, but I got it for over $1,000 cheaper (over the 36-month term). Thanks Honda!